Xero, the global small business platform, has released new data showing New Zealand small business revenue improved in May after falling in April due to the COVID-19 lockdown. The data is based on anonymised and aggregated customer data by Xero Small Business Insights (SBI).

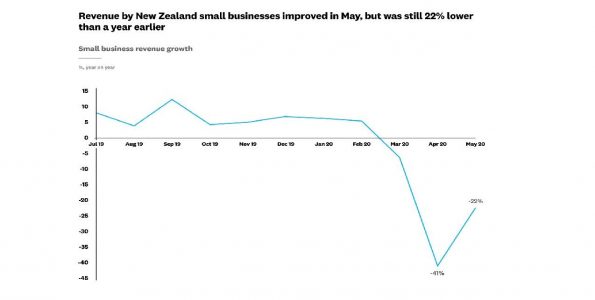

Small business revenue growth was down 22 percent year-on-year in May 2020 however this is an upswing from April 2020, which saw revenue growth down 41 percent. The data is an encouraging sign for the small business sector.

“Despite the bottoming out of revenue due to the COVID-19 lockdown in March and April, we’ve begun to see encouraging early signs of recovery in May across the small business sector,” noted Craig Hudson, managing director for New Zealand and Pacific Island at Xero.

“Weekly sales across the sector climbed between mid-April to mid-May, coinciding with the nation moving down alert levels and the economy opening up again.”

Payment times increased

The average time for small businesses to be paid extended by 3.6 days between February and May, from 25.8 days to 29.4 days.

“Keeping money moving around the country is one of the main ways we can trade ourselves out of this economic shock, so this delay in payment times is concerning,” said Hudson.

“If you can’t pay your bills it’s time to talk to your bank or at the very least the companies and people you owe money to. But anecdotally I hear from small businesses that big businesses can often be some of the largest offenders of paying invoices late. Payment delays aren't always caused by businesses not being able to pay their bills on time. It can just be a process issue, and this is basically big businesses using small businesses as a free source of credit.”

Employment recovering

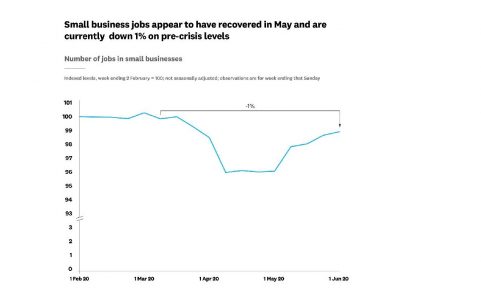

Small business employment levels recovered slightly in May, with the number of jobs in small businesses just 1 percent down on pre-COVID levels.

“It’s great to see the employment figures begin to return to normal. The rapid introduction of the wage subsidy helped plug job losses during the lockdown and has been crucial in supporting recovery as the small business sector begins to open up again,” said Hudson.

“We can further support this recovery by encouraging those who can, to shop locally and pay invoices early, or at least on time. This will help employers to employ and it will ensure money continues to circulate through the economy.”

Industry impacts

This recovery has been felt across most industries in New Zealand, particularly across hospitality businesses which were hugely affected by the nationwide lockdown.

Hospitality revenue was down by 34 percent in May year-on-year, as opposed to 77 percent in April. Construction revenue was down 21 percent year-on-year in May compared to 63 percent in April, while retail trade was down 13 percent in May compared to 46 percent in April.

“It’s encouraging to see most industry revenues improved in May. The lifting of Alert Level 3 restrictions as the nation shifted into Alert Level 2 meant retailers and hospitality outlets could open again - with limitations - to start earning revenue again,” Hudson concluded.

Xero provides a beautiful and easy-to-use cloud-based accounting software service for small businesses and their advisors around the world. Xero connects more than two million subscribers with an ecosystem of over 800 third-party apps and 200 plus connections to banks and financial service providers.

The Xero Small Business Insights program provides analysis of the sector’s health, with metrics based on anonymised, aggregated data drawn from hundreds of thousands of subscribers. The result is a picture of business conditions that’s more accurate than most private surveys, which have a far smaller sample size, and more frequently updated than other New Zealand data on small business.

Xero is currently producing a series of specialised monthly metrics, which provide a week by week view of the impact of the COVID-19 event.