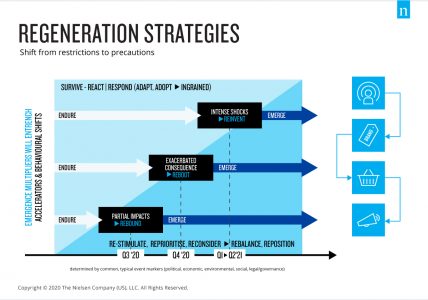

Governments around the world are creating plans to end COVID-19 lockdowns and restrictions, albeit at different speeds and in different ways. The ongoing questions for the economy are about what the future holds and how it should be managed. In response, Nielsen has identified three different time horizons for global market regeneration that go beyond the global health emergency.

The new Nielsen model has defined three possible time windows for each of the scenarios:

- Rebound: An early return to normal living conditions (reopening schools, jobs, shops, restaurants, etc.) in the third quarter of 2020.

- Reboot: A medium-term scenario that will be positioned in the fourth quarter of 2020.

- Reinvent: A long-term view that only provides for a general return to normal living conditions in the first half of 2021.

If the transition to the new normal progresses rapidly consumers and companies will return to old habits, patterns and behaviour to a large extent (rebound). However, if consumers spend a longer period of time in a lockdown situation, say until the end of fourth-quarter 020, the economic, financial and social consequences will be greater and new strategies will have to be developed to revive consumption and the economy (reboot). If the restrictions last 12-18 months, governments will be forced to compensate for the severe economic, financial and social consequences and companies will have to fundamentally rethink their product portfolios to meet changing consumer demands (re-invent).

According to its framework, which states to what extent consumers will resume old habits Nielsen has identified several areas in which an impact can be expected:

Changes in spending habits due to less disposable income

With the increased financial pressure and job insecurity, many consumers will redistribute their spending or saving in certain areas. Based on observations in previous crisis situations and consumer surveys, Nielsen believe that changes in spending patterns will particularly affect the areas of fashion, takeaway, travel/holidays and replacement purchases.

Changed shopping baskets in the FMCG sector

The past has shown that the food industry is quite crisis-proof. Even during the financial crisis in 2009, with a 2.2 percent decline in GDP, sales in the food retail sector still rose slightly. In the current situation, where almost 80 percent of consumers in surveys reflect that they want to work more from home in the future or will eat/cook more at home, we expect that daily food and fresh food will continue to show higher growth rates in the coming months, and buying fresh goods naturally requires more frequent smaller purchases.

Changed Values

Some retailers and manufacturers at home and abroad have reacted quickly to the stricter hygiene regulations with new ideas. Electronic entrance controls, contactless deliveries by driverless vehicles, new apps for safer shopping and disinfection of shopping trolleys are just a few examples. In addition, due to increased health and hygiene awareness, consumers are increasingly focusing on “healthy” products with special ingredients that have a positive effect on the immune system.

Natural and sustainable products such as “organic” or “free-from” were highly popular with consumers before the COVID-19 pandemic but have become less desirable. Now health-related product claims such as “germicidal”, “immune-system strengthening” and “health-promoting” are gaining importance.

It is critical for brands to understand which claims are appropriate for which products to ensure that they 1) meet consumer needs and 2) potentially have the ability to charge a higher price if they can differentiate their offering in the marketplace.

E-commerce

According to Nielsen’s Shopper Trends 2019 report, online grocery shopping increased penetration by five percentage points between 2015 and 2019. Since the outbreak of COVID-19, we can imagine an even faster adoption rate, attracting a larger number of food buyers to this sales channel. However, whether this growth will continue in the long term after COVID-19 is difficult to answer at present, as this depends essentially on consumer satisfaction with regard to simplicity of product selection, delivery period, delivery flexibility, delivery quality, pricing, etc.

Catering to new or strengthened needs

Prior to the pandemic, the importance of convenience was already quite prominent. In 2019, 58 percent of shoppers were doing their main shopping on a weekly basis. The trend toward “top-up” shopping and visits to convenience stores was growing.

During and after the pandemic, the need for convenience to balance the “new normal” and handle the stress from the crisis will only grow in importance for consumers. Those brands that can create a more convenient and comfortable life for consumers today, will have loyal customers tomorrow.